How to Sign Up for MTD for Income Tax (ITSA)

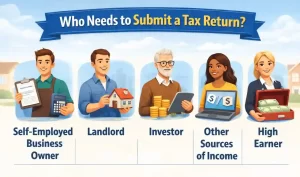

MTD for Income Tax has been introduced by HM Revenue & Customs (HMRC) and requires eligible self-employed individuals and landlords to keep digital records and submit updates using approved software. To know in detail about MTD ITSA read this blog Making Tax Digital (MTD) for...