A UK tax year runs from 6 April to the following 5 April. The last tax year started on 6 April 2023 and ended on 5 April 2024.

When we talk about important dates for tax, these include the dates ‘during the tax year’ or ‘following the end of the tax year’.

HM Revenue and Customs (HMRC) must receive your tax return and any money you owe by the deadline.

Not all of the following dates may apply to you.

| Deadline | Action |

| 31 January (during the tax year) | Make first payment on account for the tax year ending the following 5 April is due. For example, the first payment on account: for the 2023/24 tax year was due by 31 January 2024 and for the 2024/25 tax year this is due by 31 January 2025 |

| April (after the end of the tax year) | Shortly after the end of tax year anyone who has to file a tax return receives a notice to file a tax return for the tax year just ended. You may also need to file a tax return even if you do not receive a notice to submit a tax return. |

| 31 July (following the end of the tax year) | Second payment on account for the tax year ending the previous 5 April is due. For example, the second payment on account: for the 2023/24 tax year was due by 31 July 2024 and for the 2024/25 tax year this is due by 31 July 2025. Note deadline for the second payment on account for 2019/20 (normally due 31 July 2020) was delayed until 31 January 2021 owing to the coronavirus outbreak. |

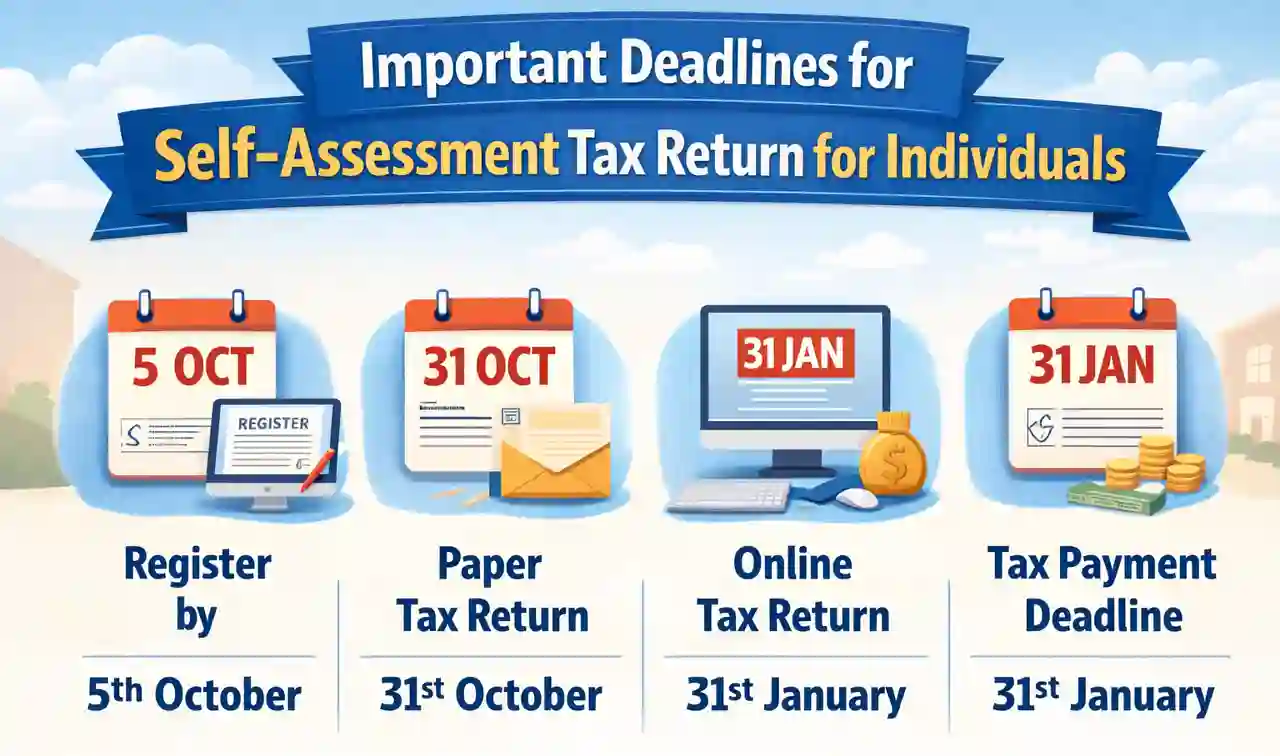

| 5 October (following the end of the tax year) | If you have not previously submitted a tax return, but you need to submit one for the tax year that ended on 5 April, you must notify HMRC by 5 October. Tell HMRC that you have income that has not been taxed and register for Self-Assessment. |

| 31 October (following the end of the tax year) | Submit the paper tax return to HMRC. There is a penalty for late filing if you send your paper tax return after this date even if you do not have any tax to pay. |

| 30 December (following the end of the tax year) | If you want HMRC to collect the tax payable by you through your tax code, this is only applicable if you file your tax return online. |

| 31 January (following the end of the tax year) | Online tax returns must be submitted by this date. A late filing penalty will be charged if you miss this deadline, even if you do not have any tax to pay or have already paid all of the tax you owe. Balancing payment of tax is also due on 31 January following the end of the tax year. For example, your balancing payment for 2023/24 is due on 31 January 2025. You may also have a payment on account to make by this date. For example, first payment on account for the 2024/25 tax year will become due on 31 January 2025. Not everyone has to make payments on account. |

| 31 January (following the end of the tax year) + 1 year | Submit amended tax return for previous tax year if you become aware that any entry on your paper or online tax return is incorrect. You can amend that return up to 12 months after 31 January following the end of the tax year. For example, if you need to amend your 2022/23 tax return you have until 31 January 2025 to make the amendment. |

At GM Accountants & Tax Consultants, our team of qualified accountants can assist and guide you on submitting your tax return, amending a previously submitted return and other tax matters. Do not hesitate to get in touch with us. If you are unable to visit our office, we can arrange a video call at your convenience. For more information, please email us at admin@gmtaxconsultants.co.uk or call us at 02037734123.