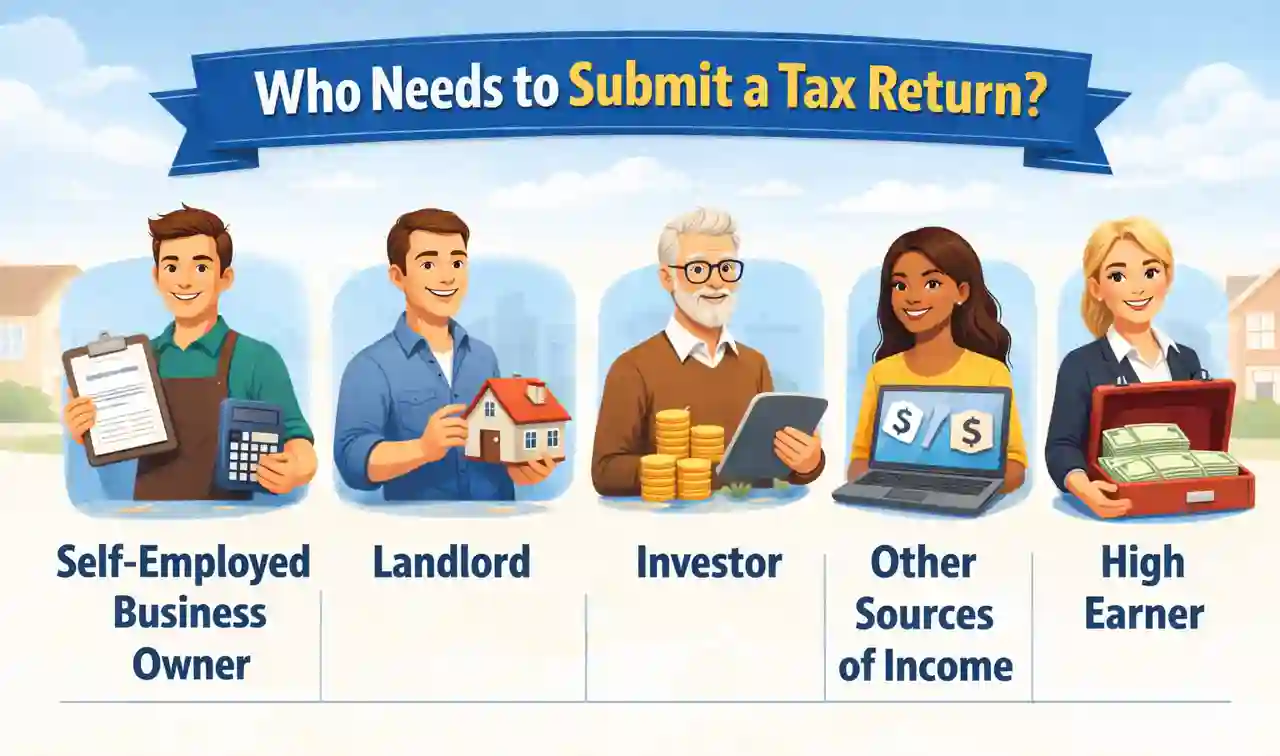

You must send a tax return if in last tax year you:

- Worked as a Self Employed and earned more than £1000 ;

- Were a partner in a business partnership ;

- Received income from renting out a property, tips and commission, income from savings, investments and dividends and foreign income ;

- Choose to fill in tax return to claim some Income tax reliefs ;

- Have to prove you were self employed e.g. to claim tax-free childcare/maternity allowance

- Got child benefit and you or your partner’s income is >£50,000 (you may also have to pay High Income Child Benefit Charge).

- Earned more than £100,000 from your employment income under PAYE.

At GM Accountants & Tax Consultants, our team of qualified accountants can assist and guide you on submitting your tax return, amending a previously submitted return and other tax matters. Do not hesitate to get in touch with us. If you are unable to visit our office, we can arrange a video call at your convenience. For more information, please email us at admin@gmtaxconsultants.co.uk or call us at 02037734123.

Disclaimer:

The information provided in this blog is for general informational purposes only and does not constitute professional accounting or tax advice. As individual circumstances may vary, readers are advised to contact us directly for advice tailored to their specific financial or tax situation.